You don’t need me to tell you that these are unprecedented times in terms of markets and investments, which must raise lots of questions in your mind.

Here are a few comments and thoughts of our own, which we hope you find helpful.

1. Firstly it is vital to keep sight of why you invested in the first place – it was for the long term, and those goals have not changed. We have seen that over the long term then markets do go up – it might not seem like that at the moment!

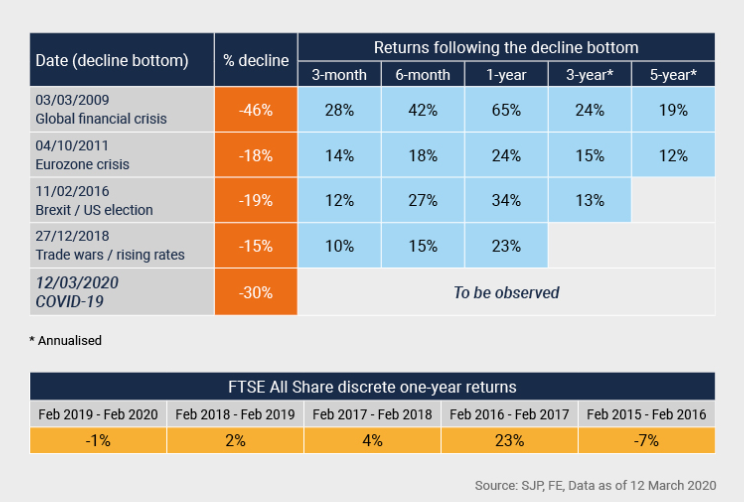

The chart below, produced by St James’s Place, provides an overview of the investment returns following other market falls:

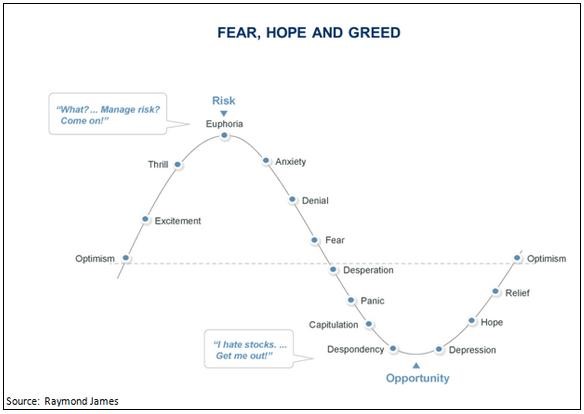

2. The chart below illustrates typical investor behaviour and shows the reason why they always get a worse return than the market itself. As above, now is not a time to panic, rather, and we know that this is very difficult, it is a time to sit on your hands. Unless you need the money for personal liquidity needs, then stay invested.

3. A number of clients are making regular contributions and I am being asked the question as to whether they should continue with these. The answer is actually down to your own situation and really comes down to your own cash needs.

If you would rather keep the money in your own bank due to worries about your own needs going forward, then stop any regular savings.

On the other side of the coin with unit prices having fallen, you will be buying a lot more units for the amount being invested which means that you will have more when prices start going back up again.

As I said, personal preference really, but, the deciding factor really has to be to look after yourselves first and then look at investments and savings.

4. Now that we are predominantly working from home then you should take this time to review your own financial position and start to revisit those long-term goals and dreams that you have.

A good starting point and what an event like this does, is to make us all consider what protection we have in place – is it sufficient for our needs? Are there any gaps?

At Corfe Wealth Management we are here to help and guide you through these events as they unfold. If you would like to discuss any of the above then please do get in contact.

Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.